The trading strategy is simple. We want to be trading two scenarios:

- Fade the opening gaps

- Trade the directional bias off VWAP

So, if the day is bearish, like today, we want to trade puts. We are always legging into spreads. We only buy when near VWAP unless we are fading gaps. Fading gaps is a rare trade as it can catch traders into buying volatility. Ideally, we should be only trading VWAP.

- Buy to Open near VWAP

- Sell to Open when candles start to get small bodies

- NEVER stay in with full risk on (BTO with no STO) past 4 hours

- NEVER close the day with BTO positions with no matchin STO legs

These are the rules. Our goal is 50% per day until we reach $25,000. Then, 10% a day to $100,000. Then, 3% a day.

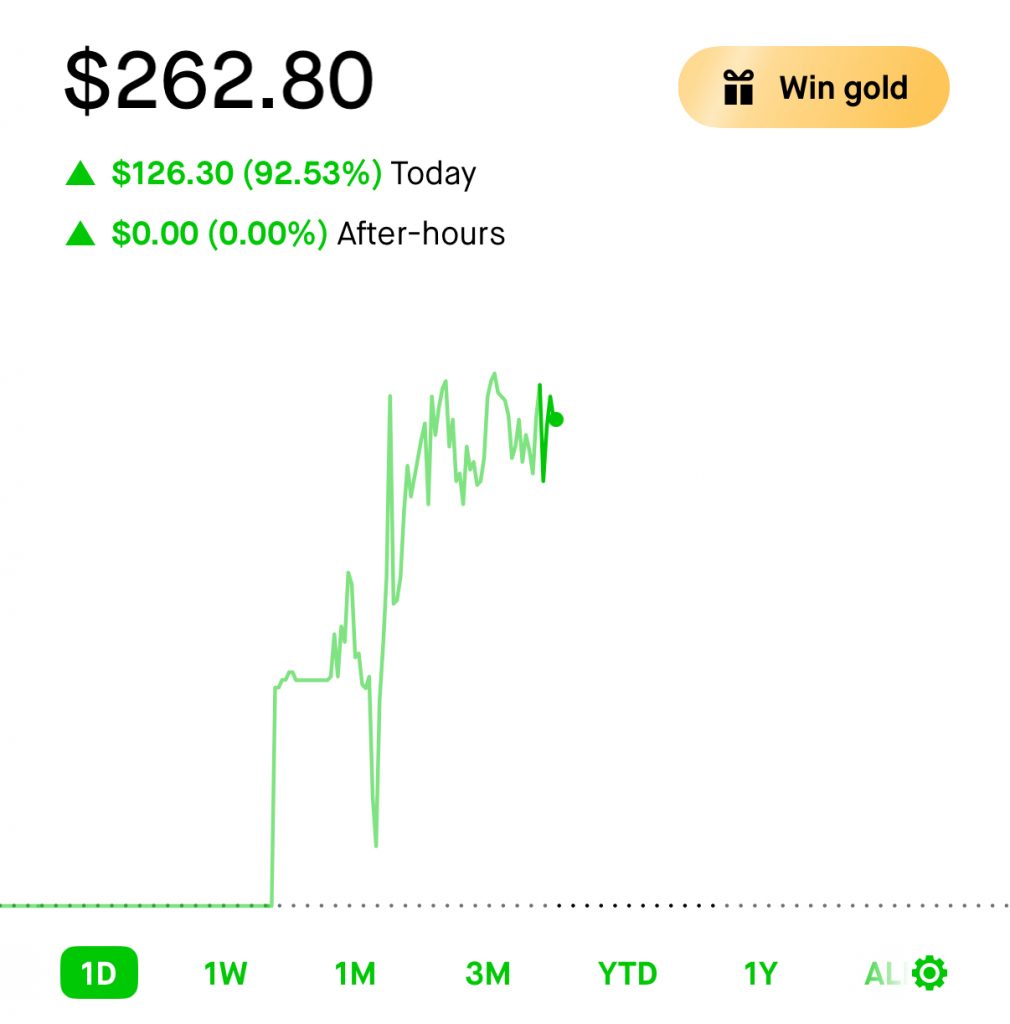

The chart below shows where the ideal trades should have been. I screwed up my executions today and traded poorly on my Sell to Open trades (green). I should have taken risk off at support zones. Instead, I got faded.

- Gold denotes Buy to open (BTO)

- Green denotes Sell to Open (STO)

- Black denotes close of spread (take profits)

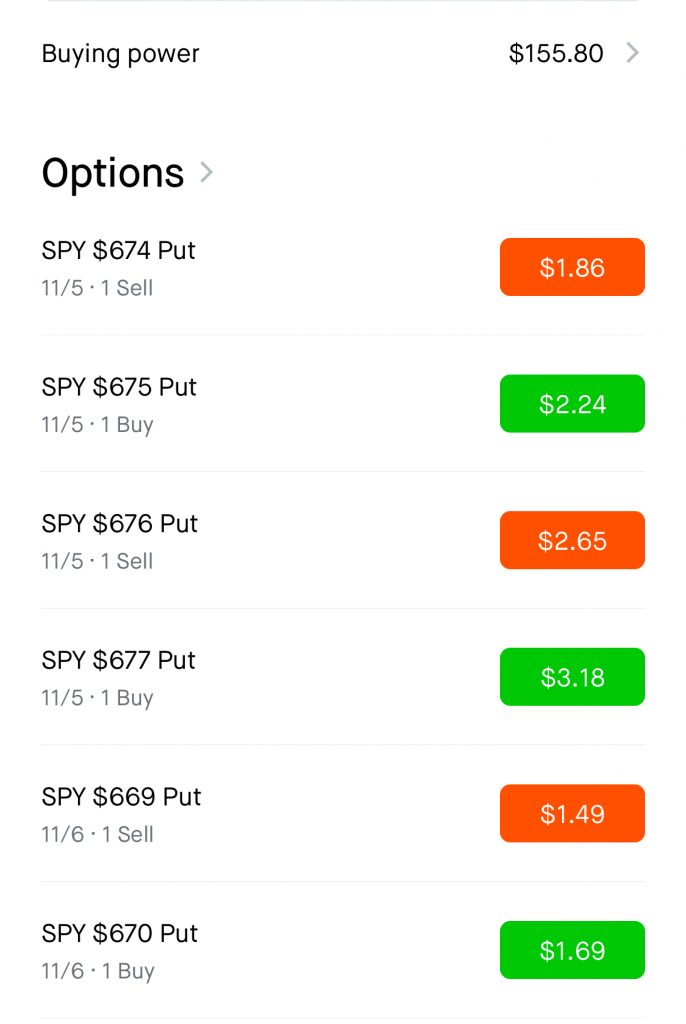

- BTO SPY 677 PUT 11/5 10:50 AM EST @ $1.92

- STO SPY 676 PUT 11/5 11:36 AM EST @ $1.59

- BTO SPY 675 PUT 11/5 11:51 AM EST @ $1.59

- STO SPY 674 PUT 11/5 12:25 AM EST @ $1.47

- BTO SPY 670 PUT 11/6 12:32 AM EST @ $1.41

- STO SPY 669 PUT 11/6 12:43 AM EST @ $1.47

So essentially, we ended up with risk on of:

- 677/676 @ -$0.33

- 675/674 @ -$0.12

- 670/669 @ +$0.06

For a total risk of $0.39, or $39. Total reward potential is $300. That is a 1:7.69 risk/reward profile.

While my execution was off today, and still reactive. The places on the charts were I made decisions to trade. Unfortunately, I waited to late and was too emotional still.

Leave a Reply

You must be logged in to post a comment.