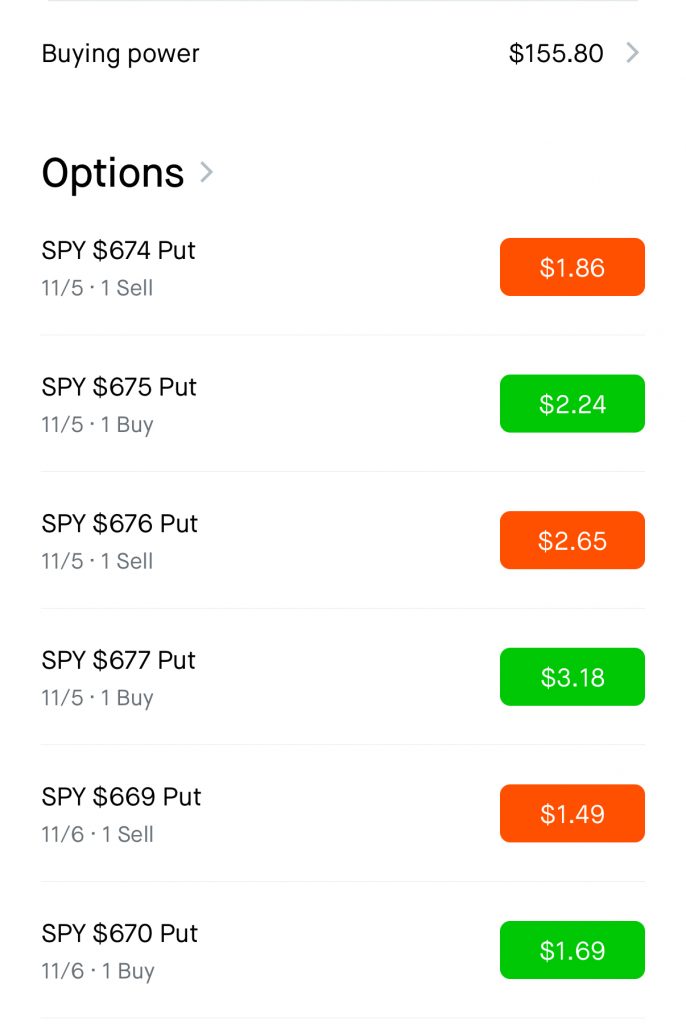

I exited previous put positions on the first green candle of the day.

- Trade 1 was executed well and yielded a net spread of -$0.08

- Trade 2 was exited too early. Still, yielded a net spread of -$0.05

- Trade 3 was a huge mistake and yielded a net cost of $0.80, offsetting most gains for the day.

Total position cost per spread is -$0.25. So, the risk:reward is 1:3. The idea is to leg into all spreads for the day at a net positive per spread. I missed an opportunity by not letting my runner ride on the second trade as the trade stayed above the 9 EMA.

My final mistake was not quitting while ahead. I played into the End of Day liquidity instead of banking my 50% day.

Leave a Reply

You must be logged in to post a comment.